When I’m out and about on my travels around the country, I’m often asked by brokers how they can maximise their clients’ borrowing potential.

I always tell them they need to set up a case in a way that’s advantageous to their clients.

So, how do you go about doing that? Let me explain how. One of the more nuanced areas of buy-to-let lending is how lenders assess affordability, particularly when it comes to the interest coverage ratio (ICR).

Typically, lenders will apply a standard ICR threshold of between 125% to 140%* for personal ownership applications, depending on factors such as income tax liabilities and ownership structures. Basic rate taxpayers are usually assessed at 125% ICR and higher rate taxpayers at 140% ICR, while the ICR for additional rate taxpayers varies from lender to lender. It’s also worth knowing the ICR can also depend on the property type being purchased, with HMOs and MUFBs often stressed higher than single dwelling properties.

But what happens when one of the applicants is a basic rate taxpayer and the other a higher, or even additional, rate taxpayer? Many lenders will automatically default to the higher ICR which means the rental income must cover a higher proportion of the mortgage payment, potentially leading to a lower loan amount.

How CHL Mortgages for Intermediaries could help

At CHL Mortgages for Intermediaries, we understand the complexity of individual circumstances. As an experienced specialist lender, we’re able to consider a blended approach to ICR affordability for combinations of borrowers who have different tax bands and shares of ownership or rental income, which can help them achieve a larger loan amount.

Here’s an example of how our blended ICRs work. It’s a fictional scenario but it demonstrates our blended ICR capability and how a different property ownership structure can help increase the loan size available.

You’re approached by a couple, let’s called them Mr and Mrs Green. They’ve recently inherited a large sum of money and rather than waste it, they’ve decided to invest in property. They’ve seen a three-bed house in their local area that they’d like to purchase and rent out. The property’s on the market for £290,000 with an estimated rental yield of £1,200 per month.

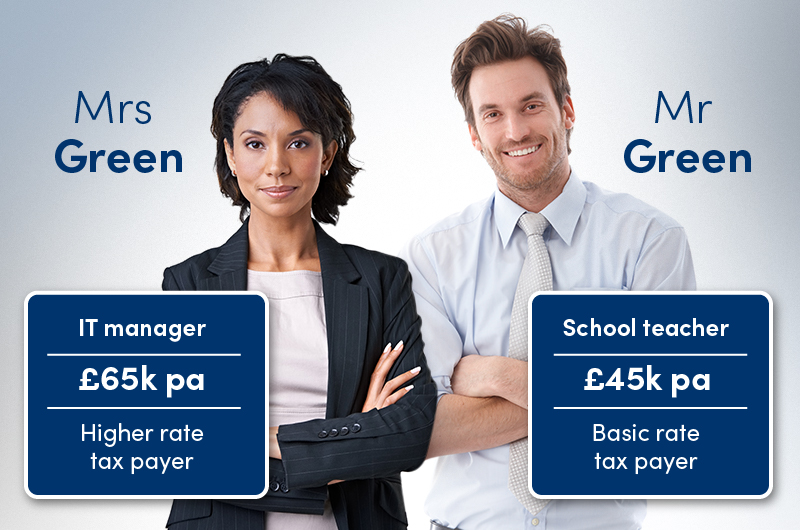

Mr Green’s a teacher in a local secondary school and is a basic rate taxpayer, earning £45,000 per annum. Mrs Green’s a higher rate taxpayer, earning £65,000 per annum working as an IT manager.

They’re looking for a 5 year buy-to-let mortgage and are aiming to borrow at 75% LTV.

However, there’s a problem. With Mrs Green being a higher rate taxpayer, most lenders are applying an ICR of 140%, meaning they can only borrow £206,956 – well below the £217,500 they need to purchase the property at 75% LTV, leaving them having to either stump up a larger deposit or find an alternative, cheaper property.

Fortunately, help’s at hand thanks to CHL Mortgages for Intermediaries. We offer blended ICRs, calculating how much your clients could borrow based on the average ICR of all applicants. With a blended approach, we’d apply an ICR of 132.5% meaning Mr and Mrs Green could now borrow up to £218,670 with us – that’s an increase of almost £12,000, meaning they can now achieve the loan amount required to purchase their desired property!

What’s more, if Mr and Mrs Green were to consider shifting their ownership structure from joint tenants to tenants in common where Mr Green would hold 99% of the property share, we can offer an even more favourable blended ICR of 125.15%, meaning the maximum borrowing amount rises to £231,513 – that’s another increase, this time by over £24,000. Wow!

With the increased loan size achieved using our blended ICR approach and a change to tenants in common, Mr and Mrs Green can now not only afford the original three-bed property, they could even afford another slightly more expensive four-bed property they’ve seen which could attract a higher yield.

It’s just another example of how our specialist way of thinking can help provide your clients with more choice. Don’t believe me? Give our blended ICR calculator a go and try it out for yourself.

As always, landlords should always seek professional tax advice when considering restructuring their property holdings and make sure they declare it appropriately to HMRC, but helping your clients understand the advantages of both blended ICRs and the differences between owning as joint tenants and tenants in common can make a massive different to their investment strategy.

To find out more about how we could help, get in touch with a member of our sales team who’ll be more than happy to have a chat and talk you through it.

*Source: Bank of England

Chetwood Bank appoints Natalie McNamara as mortgage distribution manager

Chetwood Bank appoints Natalie McNamara as mortgage distribution manager